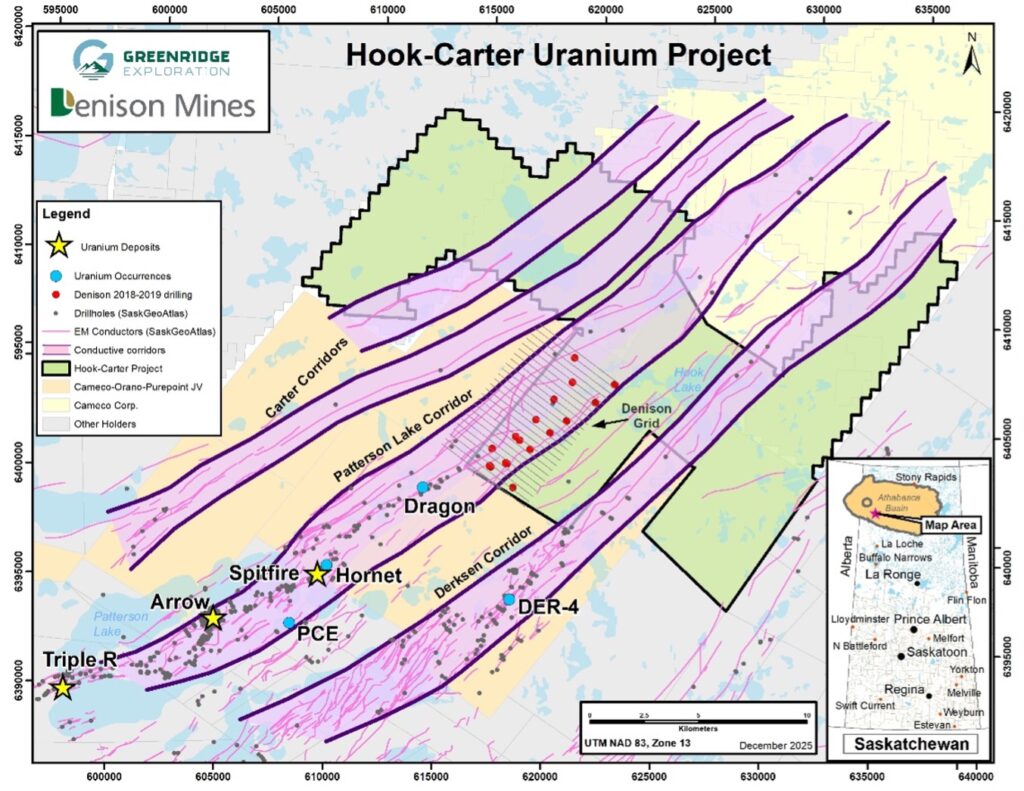

Vancouver, B.C. – Greenridge Exploration Inc. (“Greenridge”or the“Company”) (CSE: GXP | FRA: HW3 | OTCQB: GXPLF),is pleased to announce that it has established plans for a 2026 winter drilling program (the “Program”) at the Hook-Carter Uranium Project (“Hook-Carter”, or the “Project”) located in the Southwestern Athabasca Basin region of Saskatchewan, Canada. The Project is owned 20% by Greenridge and 80% by Denison Mines Corp. (“Denison”), with Denison acting as operator of exploration. Hook-Carter is interpreted to host the northeastern strike extension of the prolific Patterson Lake Corridor (“PLC”), a fertile structural trend where multiple uranium deposits and showings have been discovered to the southwest of the Project (Please see Figure 1).

Highlights of the Hook-Carter 2026 Drilling Program

- An exploration permit was received in early December 2025 that will allow for geophysical surveying and up to forty (40) drill holes, valid to December 31, 2027.

- Denison and Greenridge plan to complete up to eight (8) diamond drill holes totaling approximately 4,600 metres, beginning in January 2026.

- The 2026 targets were generated from the integration of high-resolution 2025 ground geophysical work with past exploration results that showed the hallmarks of a potential mineralizing system.

Russell Starr, Chief Executive Officer of Greenridge stated: “We are very pleased that Denison is initiating this Program at Hook-Carter, being the first drilling on the Project since 2019. During that hiatus, the exploration momentum along the PLC for high-grade uranium has been growing and Greenridge is eager to see what the 2026 drilling reveals at Hook-Carter.”

Figure 1 – Hook-Carter Uranium Project: Compilation Map of Uranium Deposits and Occurrences and Historical Exploration

The 2026 drilling Program will be carried out from a temporary work camp located on the Project and is expected to be completed by the end of March 2026. Denison is committed to collaborating with Indigenous peoples and communities to build long-term, respectful, trusting, and mutually beneficial relationships and aspires to avoid any adverse impacts of Denison’s activities and operations, which intentions are expressed in Denison’s Indigenous Peoples Policy.

About Hook-Carter

Hook-Carter consists of eleven claims covering 25,115 hectares and is located in the southwest corner of the Athabasca Basin approximately 147 kilometres northeast of La Loche, SK. Hook-Carter is interpreted to host the northeastern strike extension of the PLC, which hosts NexGen Energy’s Arrow uranium deposit (and a potential expansion of the width of the PLC with the recently discovered Patterson Corridor East zone), Paladin Energy Limited’s Triple R uranium deposit, and Purepoint Uranium Group’s Spitfire, Hornet, and Dragon zones in a joint venture with Cameco Corporation and Orano Canada (Please see Figure 1).

The Project also overlies the interpreted strike extension of the Carter and Derksen corridors, each of which represent highly prospective and under-explored structural corridors.

Details of the Hook-Carter Joint Venture Agreement

In October 2016, ALX Resources Corp. (“ALX”) and Denison entered into a purchase agreement whereby ALX sold an 80% interest in the Project in exchange for 7.5 million common shares of Denison. ALX retained a 20% interest in Hook-Carter, and Denison agreed to fund ALX’s share of the first $12.0 million of expenditures. On November 15, 2019, ALX and Denison executed a written acknowledgement with respect to the deemed formation of a joint venture between them upon Denison’s completion of a requirement to solely fund a minimum of $3.0 million of Project expenditures within an initial 36-month funding period. From 2016 to 2023, Denison’s exploration expenditures at Hook-Carter totaled approximately $7.08 million, including the completion of surface and airborne geophysical programs, as well as nearly 12,000 metres of diamond drilling.

In May 2024, the Hook-Carter joint venture was amended whereby ALX could increase its ownership interest in the Project from 20% to 25% by funding the next $3.0 million of exploration at the Project by November 2026. On December 30, 2024, ALX was acquired by Greenridge by way of a Plan of Arrangement and Greenridge beneficially assumed ALX’s ownership interest and its funding obligations in the amended Hook-Carter joint venture.

Statement of Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Sean Hillacre, M.Sc., P. Geo., a geological consultant to the Company and a Qualified Person for Greenridge as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Hillacre has examined information regarding the historical and current exploration at Hook-Carter, which includes a high-level review of the historical sampling, analytical, and procedures underlying the information and opinions contained herein.

About Greenridge Exploration Inc.

Greenridge Exploration Inc. (CSE: GXP | OTCQB: GXPLF | FRA: HW3) is a mineral exploration company dedicated to creating shareholder value through the acquisition, exploration, and development of critical mineral projects in Canada. The Company owns or has interests in 21 projects and additional claims covering approximately 274,420 hectares with considerable exposure to potential uranium, lithium, nickel, copper and gold discoveries. The Company is led by an experienced management team and board of directors with significant expertise in capital raising and advancing mining projects.

Greenridge has one of the largest uranium property portfolios in Canada consisting of 13 projects and additional prospective claims covering approximately 193,200 hectares. The Company has opportunities to realize value in a further 8 strategic metals projects which include lithium, nickel, gold, and copper exploration properties totalling approximately 81,200 hectares. Project highlights include:

- The Black Lake property, located in the NE Athabasca Basin, (40% Greenridge, 50.43% UEC, 8.57% Orano Canada) saw a 2004 discovery hole (BL-18) return 0.69% U3O8 over 4.4m.1

- The Hook-Carter property (20% Greenridge, 80% Denison Mines Corp.) is strategically located in the southwest Margin of the Athabasca Basin, sitting ~13km from NexGen Energy Ltd.’s Arrow deposit and ~20 km from Paladin Energy’s Triple R deposit.

- The Gibbons Creek property hosts high-grade uraniferous boulders located in 2013, with grades of up to 4.28% U3O8 2, and the McKenzie Lake project saw a 2023 prospecting program return three samples which included 844 ppm U-total (0.101% U3O8), 273 ppm U-total, and 259 ppm U-total.3

- The Nut Lake property located in the Thelon Basin includes historical drilling which intersected up to 9ft of 0.69% U3O8 including 4.90% U3O8 over 1ft from 8ft depth.4 In 2024, Greenridge’s prospecting program located a float sample that returned 31.13% U3O8, sourced from the Tundra Showing.5

- The Firebird Nickel property has seen two drill programs (7 holes totaling 1,339 m), where hole FN20-002 intersected 23.8 m of 0.36% Ni and 0.09% Cu, including 10.6 m of 0.55% Ni and 0.14% Cu.6

- The Electra Nickel project 2022 drill program included results of 2,040 ppm Ni over 1m and 1,260 ppm Ni over 3.5m.7

The Company has strategic partnerships which includes properties being operated and advanced by Denison and Uranium Energy Corp. The Company’s management team, board of directors, and technical team brings significant expertise in capital raising and advancing mining projects and is poised to attract new investors and raise future capital.

References:

1 – Black Lake: UEX Corporation News Release dated October 12, 2004.

2 – Gibbons Creek: Lakeland Resources Inc. News Release dated January 8, 2014.

3 – McKenzie Lake: ALX Resources Corp. New Release dated November 7, 2023.

4 – Nut Lake: 1979 Assessment Report (number 81075) by Pan Ocean Oil Ltd.

5 – Nut Lake: Greenridge Exploration Inc. News Release dated February 19, 2024.

6 – Firebird Nickel: ALX Resources Corp. New Release dated April 15, 2020.

7 – Electra Nickel: ALX Resources Corp. New Release dated July 20, 2022.

On Behalf of the Board of Directors of Greenridge

Russell Starr

Chief Executive Officer, Director

Telephone: +1 (778) 897-3388

Email: info@greenridge-exploration.com

Disclaimer for Forward-Looking Information

This news release includes certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward-looking statements or information.

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Greenridge, future growth potential for Greenridge and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of uranium, nickel, copper, gold, cobalt and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Greenridge’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

This news release contains “forward-looking information” within the meaning of the Canadian securities laws. Statements, other than statements of historical fact, may constitute forward looking information and include, without limitation, statements with respect to the Project and its mineralization potential; the Company’s objectives, goals, or future plans with respect to the Project; further exploration work on the Project in the future; and the expected benefits from the results of the Program. With respect to the forward-looking information contained in this news release, the Company has made numerous assumptions regarding, among other things, the geological, metallurgical, engineering, financial and economic advice that the Company has received is reliable and are based upon practices and methodologies which are consistent with industry standards. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies. Additionally, there are known and unknown risk factors which could cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of well results and the geology, continuity and grade of uranium, nickel, copper, gold, cobalt and other metal deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs or in construction projects and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; increased costs and restrictions on operations due to compliance with environmental and other requirements; increased costs affecting the metals industry and increased competition in the metals industry for properties, qualified personnel, and management. All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

The Canadian Securities Exchange (CSE) does not accept responsibility for the adequacy or accuracy of this release.